Quarterly Earnings per share surprises

From the quarterly earnings per share graph an analyst can gauge whether a company is growing profits, beating analyst estimates and the volatility. As an investor you want a company which is gradually growing profits, low volatility in earnings and consistently posting earnings above consensus.

Let’s look at how this can be done on our platform. Three companies, Company A, Company B and Company C and their quarterly Earnings per share series.

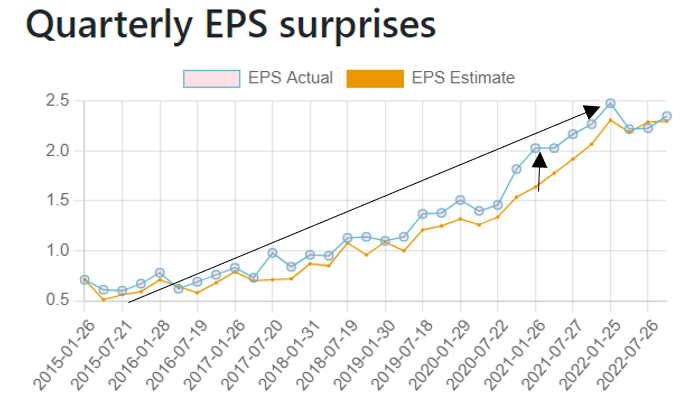

Company A

Firstly, note the direction of the trend. Company A has been increasing Earnings per share. Profits have increased 300% in the 7 years we have displayed above. Stock price performance is highly correlated with earnings, so it is expected that Company A’s share price has performed well. Secondly, the variation appears low. From quarter to quarter there is not too much variation in the results, the share price will have reflected this nature and shown less volatility all else equal. Finally, the actual results of each quarter relative to the analyst estimates are almost always above consensus. So, Company A is a firm consistently growing profits with low variation between quarters and almost always beating consensus estimates.

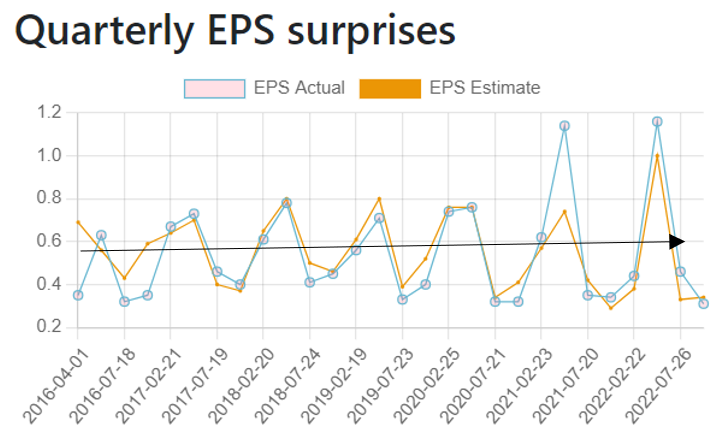

Company B

Firstly, the trend direction here is completely different. No upward trend but horizontal, indicating the company has not grown profits. However, they are consistently positive. The variation here also seems quite large. Some quarters they post Earnings per share of 1.2 and others of 0.3 so share price performance will reflect that. Finally, the company does not consistently beat consensus estimates. Company B is not a bad company it returns positive profit every quarter they are just not growing earnings on this measure.

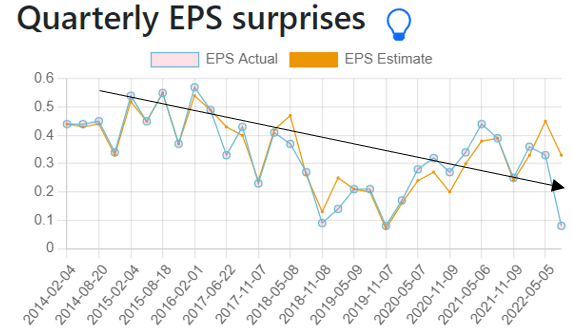

Company C

The trend here is down so the company is getting less profitable. The share price will have reflected that, so long term share price performance will not be strong. Also notice the company massively missed consensus estimates in the latest quarter so expect future guidance or analyst estimates to have been brought down.